The Parenting Lesson Most Families Overlook

You’re teaching your child how to save money. How to budget. Maybe even how to invest. But there’s a crucial life skill that often gets left out of the conversation—financial privacy and digital safety.

In a world where your child can open a bank account, invest in stocks, and shop online—all from the same screen they use for games—it’s no longer optional to talk about how to protect personal data. It’s essential.

Most parents wait until something bad happens before they teach their kids about online safety.

You’re smarter than that. And you’re here, reading this, because you want your kids to be smart and safe.

Why This Matters More Than Ever

The digital world isn’t going away. And neither are the people who try to take advantage of it.

According to Javelin Strategy & Research, over 1 million children in the U.S. were victims of identity theft in a single year, leading to over $1 billion in losses. Children are prime targets because their credit is clean—and they rarely check it.

By the time they’re 18, they could already be in debt for things they never bought.

This isn’t about fear. It’s about foresight.

Step 1: Help Kids Understand What Personal Info Really Is

Kids don’t always realize what “private” means. They’re used to sharing photos, usernames, and birthdays with friends. They might think giving their real name and address to a video game is no big deal.

But predators and scammers rely on that innocence.

Teach your kids that personal information is power—and power needs to be protected.

Explain what qualifies:

-

Full name

-

Birthday

-

Home address

-

Phone number

-

School name

-

Account usernames and passwords

-

Social Security number

Make it relatable. Say, “Your personal info is like the keys to your piggy bank. Would you hand those to someone you’ve never met?”

Reputable resource to share with your kids:

FTC: How to Protect Your Child’s Personal Information

Step 2: Make Passwords Fun—and Unbreakable

Creating strong passwords doesn’t have to be boring. In fact, it can be a creative, confidence-building activity you do together.

Here’s how:

✅ Use passphrases. Instead of something like “unicorn123,” try “UnicornsFlyHigh@88.”

✅ Add special characters. Swap letters for symbols.

✅ Keep it weird. The weirder the combo, the better.

✅ No repeats. Every site or app should have its own password.

You can even create a family password challenge—who can come up with the funniest secure password?

Then explain the why: “If someone guesses your password, they can pretend to be you—and spend your money.”

Use a password manager like Bitwarden or 1Password to keep it all safe.

Step 3: Use Role-Playing to Prepare for Real Threats

One of the best ways to teach kids financial safety is through role-play. Pretend to be a scammer asking for their Roblox login or offering free gift cards.

Then pause and ask, “What would you do?”

Let them mess up while it’s safe. Then talk through it:

-

“If someone says you won a prize but needs your bank info to claim it… what do you do?”

-

“If a friend asks for your password… do you give it?”

According to Common Sense Media, kids retain lessons best when they feel emotionally engaged. Role-playing isn’t just fun—it’s effective.

Step 4: Write a “Digital Safety Agreement” Together

Instead of laying down a list of rules, invite your child into a conversation. Let them help write your family’s digital safety rules.

Include lines like:

-

I will never share my passwords.

-

I will ask before downloading apps.

-

I will never respond to DMs or emails asking for money or personal info.

-

I will always tell a parent if something feels weird online.

Then sign it together and post it by your computer or family tablet. This small action makes it feel real and important.

Here’s a free template you can use:

📎 Family Media Agreement by Common Sense

Step 5: Teach Them to Think Before They Click

Scammers are getting smarter. They can send emails that look like banks, apps, or even your school.

Kids need to be trained to stop and think before clicking a link or downloading an app.

Teach them to ask:

-

Does this look suspicious?

-

Is this someone I know?

-

Why is this person asking for money or my info?

-

Did I expect this message?

Show them how to hover over links, look at email addresses, and report phishing attempts.

Use real examples from your inbox to walk them through it.

Helpful guide:

🛡️ Google’s Phishing Quiz

Step 6: Discuss Public Wi-Fi and Shared Devices

Many kids use school iPads, public library computers, or friend’s tablets. And most don’t understand the risks.

Teach them that logging into an account on a shared device is like writing your password on a whiteboard.

Here’s what they need to know:

-

Never save passwords on public devices.

-

Always log out of accounts after use.

-

Use mobile data instead of public Wi-Fi when accessing anything financial.

Explain that public Wi-Fi can be easily hacked. It’s fine for watching videos, but not for online banking or investing apps.

More info:

🔐 Cybersecurity Tips from CISA

Step 7: Monitor Devices with Your Kids, Not Behind Their Backs

Don’t make privacy conversations feel like punishment. Make them feel like partnership.

Once a month, sit down and go over:

-

What apps are installed

-

What permissions they ask for

-

Who’s messaging them

-

What’s in their downloads

Ask questions like:

-

“Have you seen any popups asking for info?”

-

“Did anyone ever ask you to pay for something online?”

-

“Do you know how to report something if it seems sketchy?”

This builds trust and turns you into a coach, not a spy.

Step 8: Celebrate Financial Safety Like You Celebrate Good Grades

When your child resists sharing a password or reports a scammy message, praise them like you would if they got an A+ or scored a goal.

Say things like:

-

“That was really smart. I’m proud of you.”

-

“You just protected your money and identity—that’s a big deal.”

-

“You made a grown-up choice.”

Positive reinforcement cements good behavior more than lectures.

Bonus Tip: Freeze Their Credit

If your child has a Social Security number, you can request a credit freeze with the three major bureaus—Experian, TransUnion, and Equifax—to prevent accounts being opened in their name.

This step adds another layer of protection until they’re old enough to manage their credit.

Learn how to do it:

📎 Consumer Reports: How to Freeze Your Child’s Credit

Why Mostt Cares About This

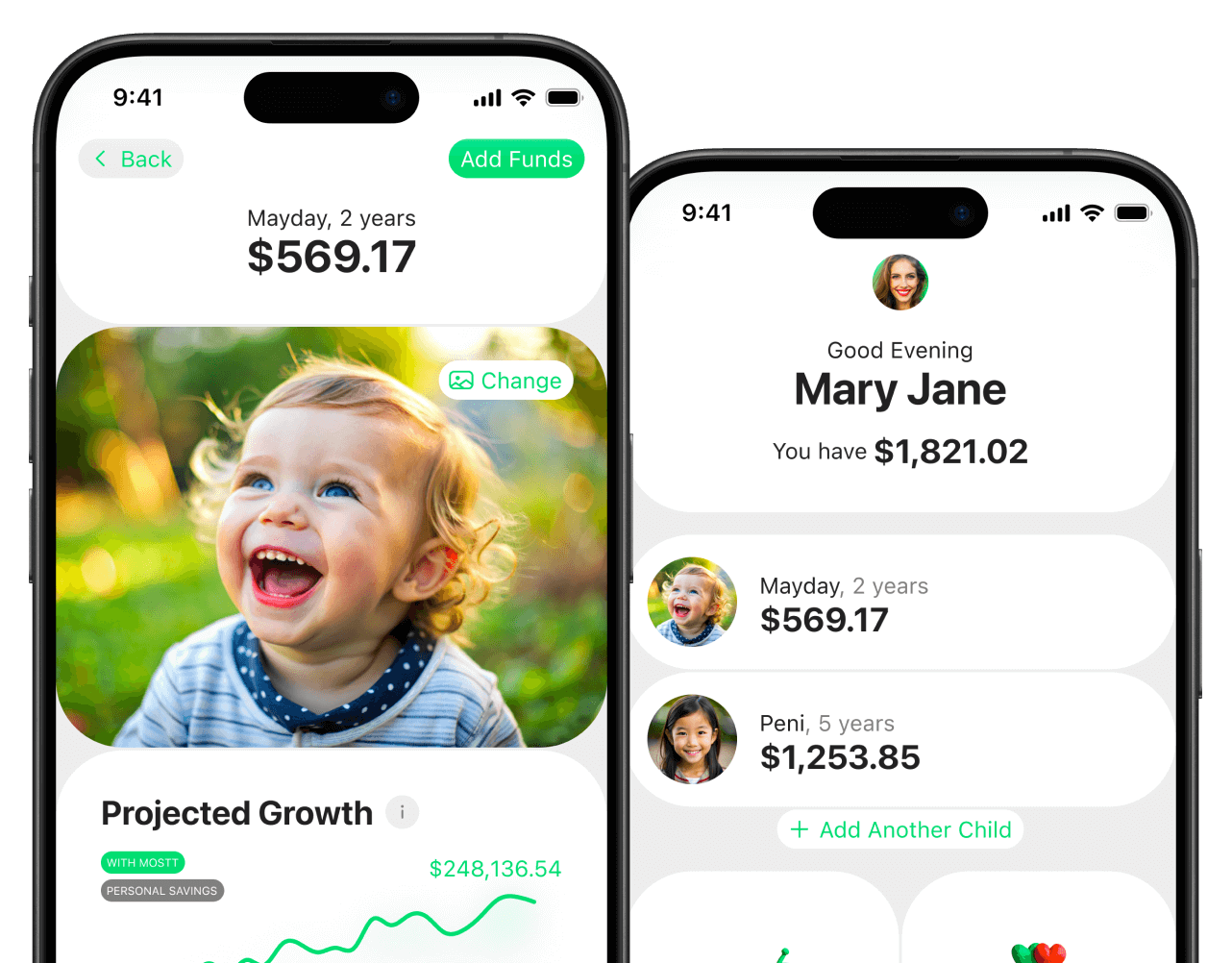

At Mostt, we help families invest for their children’s future—but we believe financial education doesn’t stop at saving and investing. It must include safety.

Because what good is a growing nest egg if it’s vulnerable to scams?

We make it easy for families to start investing with just $25/month—and we believe part of that journey is equipping your kids to keep their information private, secure, and protected.

You’re not just teaching your kids how to make money.

You’re teaching them how to safeguard it.

The Takeaway: Raise a Guardian, Not Just an Earner

Your kids won’t always be kids.

They’ll grow into adults who will one day have mortgages, online accounts, investment portfolios, and businesses of their own.

By teaching them about financial privacy now, you’re laying a foundation of trust, wisdom, and confidence that will follow them for life.

And the best part?

They’ll remember who taught them.

Start Today with These 3 Simple Steps:

-

Pick one safety tip from this list and talk about it at dinner.

-

Create your family’s digital safety agreement.

-

Download a password manager together.

Want to raise money-smart, security-savvy kids?

👉 Start your Mostt account today — where financial education meets family-first investing.